Stock Analysis

Started in 1986 by five brothers of the Guillemot family, Ubisoft is today globally recognized as one of the most renowned game publishers in the world. Its portfolio includes iconic games like Tom Clancy, Assassin’s Creed, and Watch Dogs. Throughout the late 1990s and early 2000s, Ubisoft expanded its portfolio and global presence by acquiring several game studios that enabled it to diversify its game offerings and tap into new markets.

With the 1995 debut of “Rayman,” an original platformer game, Ubisoft had its first successful game. The game became an instant financial success, solidifying Ubisoft’s reputation as a company capable of creating top-notch, unique content. The focus on creating franchises such as “Assassin’s Creed,” “Far Cry” and “Just Dance” has served well for Ubisoft with all of these titles becoming the pillars of their business.

Business Overview

Ubisoft’s main business activities involve the production, publishing, distribution and “operation” of video games for consoles, PC and mobile. The main strategy of the company has been to continue backing its already-established titles while launching new games to diversify its offerings and tap into new customer segments.

Financial Analysis

| 2020-21 | 2021-22 | 2022-23 | H1 23-24 | |||||

| Amount | YoY Change | Amount | YoY Change | Amount | YoY Change | Amount | YoY Change | |

| IFRS 15 Sales | 2,223.8 | 39.4% | 2,125.2 | -4.4% | 1,814.3 | -14.6% | 836.0 | 14.3% |

| Cost of sales | 325.8 | 14.5% | 269.7 | 12.7% | 216.6 | 12.5% | (88.3) | 10.7% |

| Gross Profit* | 1,898.0 | 85.5% | 1,855.5 | 87.3% | 1,597.7 | 87.5% | 924.3 | 89.3% |

| IFRS Operating income/(loss) | 289.4 | 241.5 | (585.8) | 16.1 | ||||

| IFRS Net income (loss) | 105.2 | 79.5 | (494.7) | (34.4) | ||||

| IFRS Diluted EPS | 0.85 | 0.65 | (4.08) | (0.28) | ||||

| Total R&D expenditure | 827.1 | +15% | 822.5 | (1%) | 1,440.4 | +75% | 430.5 | -12% |

| Long-term borrowings and other financial liabilities | 1,894.9 | +61% | 1,420.3 | (25%) | 2,325.2 | +64% | 1,822.4 | 24% |

| Cash and cash equivalents | 1,627.7 | +51% | 1,452.5 | (11%) | 1,490.9 | +3% | 1,305.2 | -15% |

| Non-IFRS Cash Flow from operation | 64.6 | (55.0) | (227.3) | (188.7) | ||||

| Non-IFRS Net Free Cash Flow | 72.3 | (282.0) | (425.8) | (284.2) | ||||

An analysis of the key financial figures for Ubisoft reveals the following information:

- Gross profit has declined from 2021-22 to 2022-23 (€1898 Mn to €1598 Mn), which presents a cause for concern. The drop in gross profit is mainly due to a decline in sales, which represents the question if the gaming market is declining. H1 23-24 has shown a good recovery by registering a YoY increase in sales by 14.3% and an increase in gross profit by 89.3%. It seems Ubisoft is slowly coming back to its 2020-21 levels.

- Operating income has declined from €289.4 Mn in 2020-21 to an operating loss of €585.8 Mn in 2022-23. Net Income is showing a similar trend with a decline from €105.2 Mn in 2020-21 to a net loss of €494.7 Mn in 2022-23. H1 23-24 has shown a good recovery with a net income of €16.1 Mn.

- R&D Expenditure for Ubisoft has increased from €827.1 Mn in 2020-21 to €1440.4 Mn in 2022-23. The increase in R&D Expenses is a good sign as it means the company is continuously innovating and spending money to invest in its future.

- Ubisoft’s cash position appears to have remained constant with Cash & Cash Equivalents standing at €1627.7 Mn in 2020-21 to €1409.9 Mn in 2022-23. It allows the company to invest more in the development of new products.

- Cash flow from operations and Free Cash Flow has declined which is worrisome as it shows the indication of either a drop in the company’s efficiency to convert sales and bring in cash or the market is declining.

Overall, Ubisoft’s sales and profits have dropped compared to the 2020-21 levels. However, it appears that the company is recovering from this. For FY 2023-24, Ubisoft’s management has provided guidance for strong net bookings growth and non-IFRS operating income of around €400 million.

Share Price Performance

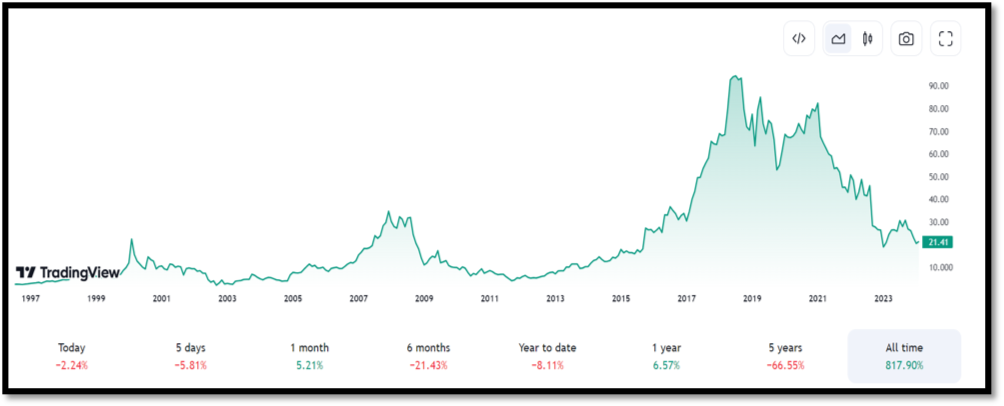

When Ubisoft first went public in 1997, its share price was about EUR 2.7.

The share price of Ubisoft has been very volatile over the last five to six years, going as high as EUR 108 in July 2018 and currently trading at EUR 21. Ubisoft’s current market capitalization is around EUR 2.81 billion. On the financial front, the company’s revenue and profits have declined in the past 3-4 years. By looking at the share price, it seems to have already been factored in by the market. P/E and EPS Data are currently available for the company as it has a Net Loss.

Ubisoft’s share appears to be trading at a decent price and has already seen a drop due to its declining financials. If financials improve, the share price might rise to where it was before, above EUR 100, or perhaps surpass its former record high.

Shareholder Structure

Guillemot Brother and their entire family hold about 15.3% of the Share Capital while having net voting rights of 20.5%. Tencent, the world’s biggest game publisher and the brain behind the action sensation game PUB-G has been strategically investing in Ubisoft, currently holding 9.99% of the share capital and has net voting rights of 9.2%. The public holds around 71% of Ubisoft’s shares, having around 67% net voting rights.

Risks

While Ubisoft has been growing, many challenges in its path exist that continue to pose a risk for its investors. The losses incurred by the company in the recent two years, along with a negative cash flow from operations and negative free cash flow, raise eyebrows about the company’s financial sustainability. Ubisoft also faces competition from major gaming companies like EA, Activision, Tencent, Microsoft, and Nintendo, as well as smaller independent publishers. Developing a game demands significant monetary investment and effort. Success is not assured and relies on several elements to become profitable.

Future

The recent investment by Tencent into Ubisoft reflects Tencent’s confidence in Ubisoft’s potential to bring its biggest IPs to mobile. The partnership is already bearing fruits with Ubisoft’s latest game, Assassin’s Creed Codename Jade, published by Tencent’s subsidiary Level Infinite. Ubisoft called this “one of the biggest publishing deals ever signed in the industry.”

The worldwide video game market decreased by 5% in 2022 and is projected to grow by 3% in 2023. The upcoming release of games like Assassin’s Creed Jade, Prince of Persia: The Lost Crown, Skull and Bones, and the continued success of the company’s current products are crucial to its plans for growth.

Should you Buy or Sell Ubisoft Stock

I recommend potential investors to sell Ubisoft’s shares due to the existing risks of high competition and low margins. The company’s partnership with Tencent can be a game changer as Tencent is already the market leader in the gaming category. However, the risks for Ubisoft currently outweigh the benefits. Investors should wait for the full-year results of 2023-24 and one more fiscal result to assess the company’s growth before making a well-informed decision.

Signature Block

Aaditya Shah

Freelance Finance Content Writer