(OTCMKTS: SGAMY)

Stock Analysis

As kids, we all played fun games from the Sega Sammy group, which had classics like Sonic the Hedgehog, Aladdin, Like a Dragon Series, and many more. The company was formed in 2004 when SEGA CORPORATION and Sammy CORPORATION joined hands. It is now one of the biggest video game producers in the world. The entity has a notable history in the gaming industry, with Sega established in 1940 and Sammy Corporation founded in 1975.

Sega Sammy has ownership stakes in more than fifty businesses in Japan and around the world. A once-small gaming company, Sega Sammy Holdings is now a multi-million dollar entertainment powerhouse with operations in gaming, resorts, and pachislot and pachinko machines.

The Story

Sega was established in 1940 in Honolulu, Hawaii. Initially, the company focused on providing coin-operated amusement machines to military bases. A few years later, Sega shifted its focus to Japan and expanded its presence in the arcade gaming industry.

Sammy Corporation began its operations in 1975 in Japan. The company initially started as a pachinko machine manufacturer, capitalizing on the popularity of the Japanese gambling game. Over the years, Sammy diversified its operations into various entertainment sectors, including arcade games, toys, and even pachislot machines.

The 2000s marked a pivotal point in the gaming industry with stiff competition from companies such as Nintendo and Sony that invested heavily in the market and gearing up to launch their new gaming consoles.

In the early 2000s, Sega faced financial difficulties due to the under performance of the Dreamcast (its video game console) and increasing competition. To stay afloat, Sega was on the lookout for partnerships and alliances. This led to the historic merger between Sega and Sammy Corporation in 2004, forming Sega Sammy Holdings Inc. The merger combined Sega’s expertise in video games and arcade machines with Sammy’s strength in pachinko and pachislot machines.

Business Overview

The Sega Sammy group is an established player in the entertainment industry operating in different businesses such as consumer and arcade game content, toys and animation; the Pachislot and Pachinko Machines Business; and the Resort Business, which develops and operates hotels. The group’s mission is to make life more colourful and create captivating experiences for its consumers.

Financial Analysis

| Particulars | 2021 | YoY Change | 2022 | YoY Change | 2023 | YoY Change | 2024 Q3 | YoY Change | Average Growth |

| Earnings Information | |||||||||

| Net sales | 2,77,748 | -24% | 3,20,949 | 13% | 3,89,635 | 18% | 3,49,924 | 29% | 9% |

| Cost of sales | 1,76,973 | 135% | 1,93,081 | 8% | 2,31,568 | 17% | 1,96,769 | 26% | 47% |

| Gross profit | 1,00,775 | -56% | 1,27,868 | 21% | 1,58,067 | 19% | 1,53,155 | 32% | 4% |

| Operating income | 6,553 | -95% | 32,042 | 80% | 46,789 | 32% | 54,445 | 42% | 15% |

| Ordinary income | 1,715 | -98% | 33,344 | 95% | 49,473 | 33% | 57,296 | 43% | 18% |

| Profit attributable to owners of parent | 1,274 | -95% | 37,027 | 97% | 45,938 | 19% | 35,327 | 8% | 7% |

| Balance Sheet Information* | |||||||||

| Total assets | 4,21,599 | -8% | 4,35,492 | 3% | 5,01,566 | 13% | 6,15,671 | 23% | 8% |

| Shareholders’ equity | 2,90,759 | -1% | 2,92,411 | 1% | 3,30,854 | 12% | 3,37,468 | 3% | 4% |

| Cash and Cash equivalents | 1,54,540 | -3% | 1,52,459 | -1% | 1,79,509 | 15% | 1,69,726 | -6% | 1% |

| Current liabilities | 59,777 | -31% | 86,986 | 31% | 1,20,332 | 28% | 2,15,898 | 8% | 9% |

| R&D expenses | 61,969 | -19% | 68,927 | 10% | 80,434 | 14% | N.A. | N.A. | |

| Employee | |||||||||

| Number of employees | 7,535 | 7,760 | 8,219 | N.A. | N.A. | ||||

| Sales per employee | 36.9 | 41.4 | 47.4 | N.A. | N.A. |

*All Information other than employees and YoY Change (%) is in Millions of Yen

An analysis of the key financial figures for Sega Sammy reveals the following information:

- Net Sales for Sega Sammy have improved significantly from JPY 277.74 Mn in 2021 to JPY 349.92 Mn in 2024 Q3, representing a CAGR growth of 8%, even without taking the Q4 numbers into account. Sega Sammy’s business was severely impacted in 2021, a decline that can be attributed to the global pandemic-related losses that businesses worldwide faced.

- Gross Profit, Operating Income, and Net Profit have also improved considerably. They have grown at an average growth rate of 4%, 15%, and 7%, respectively. From 2021-2024, Gross Profit increased at a CAGR of 15%, Operating Income increased at a CAGR of 103%, and Net Profit increased at a CAGR of 203%, and that’s before we even consider the numbers from 2024 Q4.

- On the balance sheet front, both Total Assets and current liabilities have grown at the same rate of 8%. Cash and Cash equivalents have remained at the same levels in 2024 compared to 2020 with cash standing at JPY 169.72 Mn in 2024 compared to JPY 154.45 Mn in 2021.

| Ratio Analysis | 2021 | 2022 | 2023 | 2024 Q3 | Average |

| Gross Profit Margin | 36% | 40% | 41% | 44% | 40% |

| Operating Profit Margin | 2% | 10% | 12% | 16% | 10% |

| Net Profit Margin | 0.46% | 11.54% | 11.79% | 10.10% | 8% |

| Return on Equity | 0.44% | 12.66% | 13.88% | 10.47% | 9% |

| Cash Ratio | 2.59 | 1.75 | 1.49 | 0.79 | 1.65 |

The ratio analysis for Sega Sammy reveals the following information:

- Profit Margins for Sega Sammy have improved considerably from 2021 to 2024, indicating improved financial performance.

- Gross Profit margin improved from 36% in 2021 to 44% in FY24 Q3, clocking an average margin of 40%. Operating Profit margin improved from 2% in 2021 to 16% in FY24 Q3, clocking an average margin of 10%. Net Profit margin improved from 0.46% in 2021 to 10.10% in FY24 Q3, clocking an average margin of 8%.

- ROE for Sega Sammy has improved in similar lines to Net Profit, while Cash Ratio has declined from 2.59 in 2021 to 0.79 in 2024. The declining cash ratio is a cause for concern as it means the company has less cash in the bank to fund existing liabilities and future business expansion plans.

- Since 2021, when revenues and profit margins both took a nosedive due to the pandemic, there have been significant improvements in ROE and profit margins. The business has made a full recovery and is now expanding steadily.

Share Price Performance

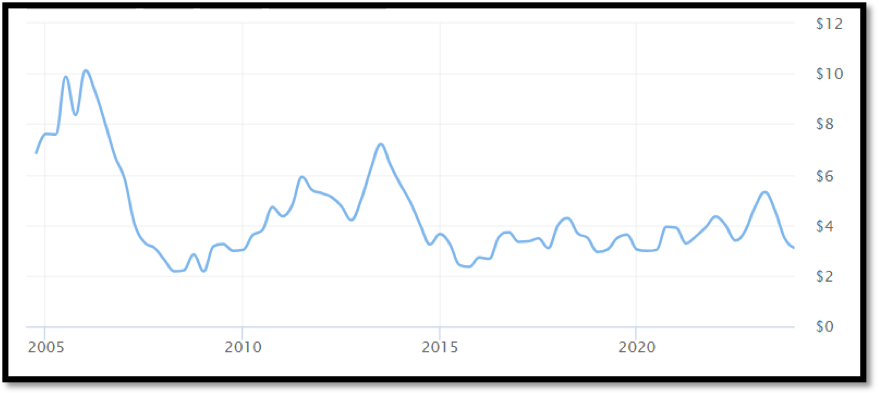

Sega Sammy Shares have been on the market since 2004. The price of the initially issued share was about $6. The shares of Sega Sammy ADR are currently trading at $3.27 in the US OTC Markets with a market cap of $2.7 Bn. Sega Sammy’s share price has stayed between $3 and $5 from 2020 to 2023, which means investors haven’t made much money.

Currently trading at a PE Ratio of around 7.94 and with a dividend yield of 2.59%, the company looks like a good bet. The sole concern of investors would be whether the firm can maintain its better financial performance while also generating satisfactory returns on the share price.

Risks

The 5 Yr. Average Beta for Sega Sammy shares is 0.2, meaning low volatility for its shares, along with remaining stable within a certain range for an extended period. Sega Sammy is a highly creditworthy and well-respected company, as indicated by its A- bond rating Rating and Investment Information (R&I). Also, the high rating means the company can easily get debt from financial institutions at moderate interest rates that it can use to support its business expansion plans.

Global giants like Sony, Nintendo, Ubisoft, and EA, in addition to local start-ups, present a significant competitive threat to Sega Sammy’s business. The level of technology is also constantly evolving in the gaming industry with the launch of artificial intelligence (AI), and the future looks highly unpredictable with trends changing quickly.

Future

The management team of Sega Sammy has devised a long-term plan till 2030 that focuses on initiatives such as creating super games that would be major global hits, becoming the no.1 utilization share of pachislot and pachinko machines, and exploring new opportunities in Japan as well overseas for its resorts business while entering into casino and sports betting business. To fund its growth initiatives, Sega Sammy’s management has already devised a plan to spend JPY 100 billion over the next five years.

Recently, Sega Sammy purchased Rovio games in 2023, the developer behind the popular game Angry Birds, at a valuation of around $775 million. With the purchase of Rovio, Sega would have a stronger foothold in the mobile space. In April 2023, Sega Sammy CEO Haruki Satomi said that “the mobile gaming market has especially high potential, and it has been Sega’s long-term goal to accelerate its expansion in this field.”

Should you Buy or Sell Sega Sammy Stock

Sega Sammy stock is a good buy due to its improving financials, and the company’s management has devised a good long-term plan to grow their business. The company has already built a strong reputation for several of its intellectual properties (IPs). It is now focusing on releasing new titles while exploring the acquisition of new companies and entry into new businesses.

Sega Sammy has shown great resilience and improvement on the financial front, with its net profit increasing from JPY 5,369 Mn in 2016 to JPY 45,938 Mn in 2023. The only thing that remains to be seen is if Sega Sammy can maintain its current level of growth while facing increasing risks like intense competition and a constantly changing market.

Author:

Aaditya Shah

(Freelance Finance Content Writer)