BowFlex, formerly known as “Nautilus Inc.” is a fitness solutions company that provides tools and education necessary to help people achieve a fit and healthy lifestyle. Recently Bowlfex grabbed headlines as it filed for bankruptcy last week.

BowFlex Inc. was founded in 1986 and is headquartered in Vancouver, Washington and has it’s user base in the United States, Canada, Europe, the Middle East, Africa, and internationally. The company operates through two segments, Direct and Retail. It offers cardio products, exercise bikes, treadmills, ellipticals, home gyms, dumbbells, kettlebells, and barbells primarily under the Nautilus, Bowflex, and Schwinn brands, as well as digital fitness platform under the JRNY brand. Bowflex became famous for its innovative approach to home fitness, convenience, effective marketing strategies, celebrity endorsements, and the tangible results achieved by its users. These factors combined to propel Bowflex to prominence in the fitness industry and establish it as a household name synonymous with home gym equipment. However, company has had financial difficulties in recent years, and this week it declared that it is filing for bankruptcy in order to speed up the sale process.

The company was formerly known as Nautilus, Inc. and changed its name to BowFlex Inc. in November 2023. BowFlex Inc. was founded in 1986 and is headquartered in Vancouver, Washington. On March 4, 2024, BowFlex Inc. filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the District of New Jersey. “The company cannot be certain that holders of the company’s common stock will receive any payment or other distribution on account of those shares following the Chapter 11 cases,” said the filing. Following this, the New York Stock Exchange delisted their shares, meaning they are no longer tradable on that exchange.

BowFlex Inc. is now available only on the OTC Markets Group as BFXXQ, which was formerly available on the New York Stock Exchange as BFX (last traded on March 4 with the closing price of $0.19 per share).

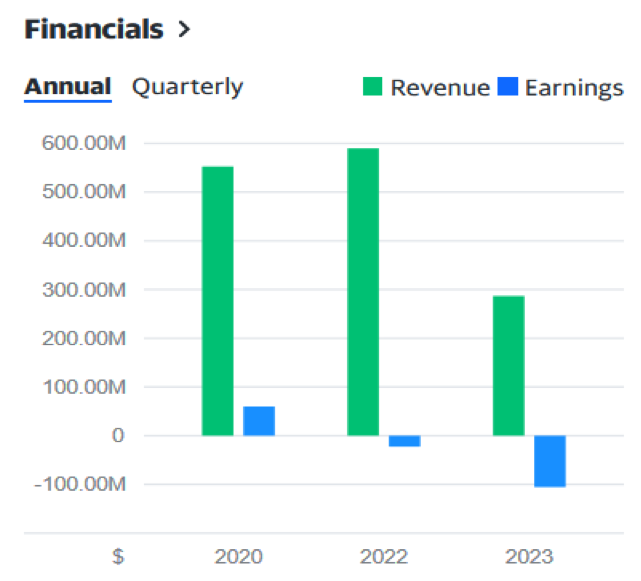

The company’s decision was expected after it stated in its most recent earnings announcement that there was “substantial doubt” about its ability to continue as a going concern, following a loss and sales that were significantly lower than the same period last year. Sales dropped from $65.5 million in the year-earlier quarter to $48.7 million in the second quarter of its fiscal year. In 2022, sales reached a peak of $590 million during the fourth quarter.

BowFlex gets more than 46% of its revenue from cardio products, which experienced a 28.5% drop in direct-to-consumer sales for the last nine months of 2023, compared to the same period a year earlier.

BowFlex also signaled it intends to lay off more than 200 employees, enter Chapter 11 bankruptcy reorganization and sell its assets, including the BowFlex headquarters shown above in Vancouver, Washington. Following the pandemic, manufacturers of home exercise equipment have faced challenges as Americans flocked back to the gym and as the use of weight-loss medications increased. BowFlex isn’t the only at-home fitness provider suffering with the pandemic. Peloton’s stock price has also fallen on several occasions, most recently by 23% when the company reduced its full-year sales prediction for 2024.

Now let’s talk about the stock price specific data of the company. In the past year, the stock has lost 97% of its value, while the S&P 500 has increased by 27%. As of March 8th, 2024, BFXXQ traded around $0.031 per share, and its price has been volatile in recent months.

The New York Stock Exchange (NYSE) issued a listing notice to the company in late November for failing to maintain “an average global market capitalization of at least $50.0 million over a consecutive 30-day trading period and, at the same time, a total stockholders’ equity equal to or greater than $50.0 million.”

What’s next for BowFlex?

After this fiasco, Investors are thinking weather there is any possibility of recovery from bankruptcy for the company or not. BowFlex announced on Tuesday that it had obtained a $25 Million debtor-in-possession (DIP) loan from creditors and had signed an asset acquisition agreement, also referred to as a “stalking horse” which means another company has expressed interest in buying Bowflex’s assets. DIP loans let businesses pay their employees and suppliers even as they file for bankruptcy. They added, Taiwan-based Johnson Health Tech(the “Stalking Horse Bidder”) would acquire substantially all of the assets for $37.5 million in cash.

BowFlex CEO attributed its bankruptcy on the “post-pandemic environment and persistent macroeconomic headwinds” and stated that company had interest from “multiple” companies but chose Johnson Health Tech because it will maximize value for our stakeholders through this process. Johnson Health Tech makes similar exercise equipment under the Matrix, Horizon Fitness and Vision Fitness brands. It also has nearly 500 global locations of its retail store using the Johnson name.

In accordance with Section 363 of Chapter 11 of the U.S. Bankruptcy Code, the Company seeks approval of the proposed transaction. This approval will enable outside interested parties to submit bids that are higher or better. The transaction is contingent to the Bankruptcy Court’s approval, any additional legal requirements, and other customary terms.

BowFlex noted in its Worker Adjustment and Retraining Notification Act letter, received by Washington’s Employment Services on March 4, that a different entity could emerge as the Vancouver company’s ultimate buyer, “but that will not be determined until on or about April 12, 2024.” The “targeted closing date” for BowFlex’s planned purchase is a week later, on April 19.

Due to the bankruptcy filing, the future of BowFlex, including its brand and products is uncertain. The stock might be delisted from the OTCMKTS as well, and its value could fluctuate significantly. Be cautious of any investment advice related to Bowflex stock due to the high level of risk.

Author:

Pranav Jain

Stock Research Analyst

115, Jaipur, Rajasthan, India 302033.