Introduction

In a magazine article many years ago, the legendary investor Benjamin Graham advised his readers to buy their stocks as they bought their groceries, not as they bought their perfume.

This advice serves as a great testament to what we have for you today. A value stock on bargain!

From the far East to the developed nations in the West. One thing they all have in common is the rising interest in Anime and by extension Anime-related products. In light of this growing industry and the sad demise of Dragon Ball’s author which took the world by shock, we bring to you an analysis of Bandai Namco Holdings Inc. – A Japanese entertainment company.

Company Overview

The company operates in the entertainment industry, developing video games, toys, and animation content serving as a backbone for the Anime Industry worldwide. They provide their services through four main segments: Digital Business, Toys (Action Figures), IP Production Business and The Amusement Business.

With a diverse portfolio of popular franchises like Pac-Man, Dragon Ball, One Piece and Gundam, the company has a strong foothold in both domestic and international markets.

Financial Performance

Now that we have understood the climate in which the company operates in, let’s dive into some numbers.

Stock Price Movement

A quick study of Bandai’s stock movement in the past 5 years shows a slow yet consistent upward climb. However, what’s noteworthy is the spike the stock experienced in 2020 – A year that we all know wasn’t very friendly to either people or capital markets.

In roughly the last three quarters of 2020 (3/8/2020 to 11/22/2020), the stock gained a whooping 94%, which speaks volumes to the company’s capability of weathering systemic risks faced by the market.

2021 onwards till date we see that the share price has been in a consolidation phase, roughly fluctuating around the same mean value. When a stock fluctuates in this phase, the future is uncertain, and this can be taken as both a negative and positive.

Financial Metrics

In recent years, Bandai Namco has demonstrated steady revenue growth driven by strong sales of its video game titles and merchandise. With a Year-On-Year change of 11.34%, the firm has been successful in expanding their market share in the industry.

Profitability remains solid, supported by efficient cost management allowing the company’s Net Income to rise by about 50% over the past 5 years.However, the company has experienced some fluctuations in earnings due to seasonal variations in game releases and Net Income faltered in years 2020 and 2021 as can be seen in the chart above.

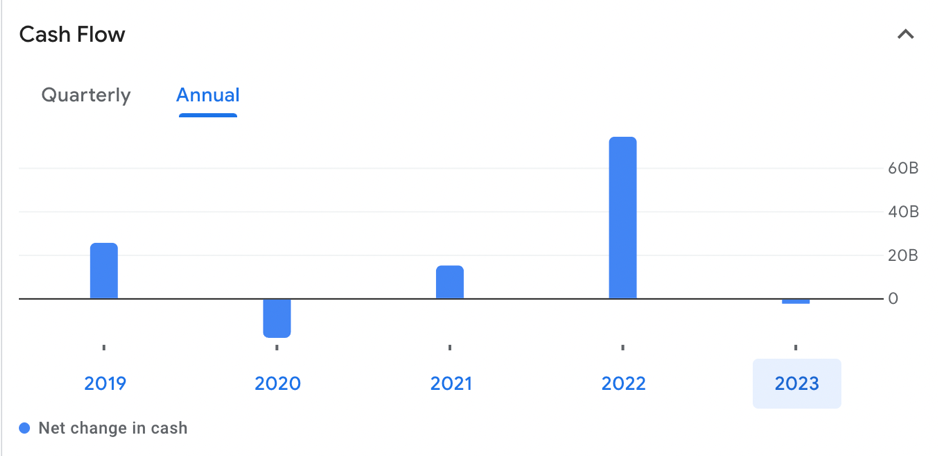

In Synchronization with Net Income, the firm faced Cash Flow challenges during 2020 and 2021, owing primarily to Capital Expenditures made to expand the firm’s Asset Base. 2022 was by far the best year in terms of Cash Flow as it was a successful year in terms of both Revenue and Income for the firm.

In the previous year, the company’s Cash Flow again went negative despite the rising Revenues as the firm is focused on investing heavily in growth, signaling a positive outlook for the future of the company.

Market Potential and Recent News

Bandai Namco operates in a rapidly growing entertainment industry, fueled by increasing demand for video games and anime content globally. With a strong brand presence and a loyal fan base, the company is well-positioned to capitalize on emerging trends and expand its market share.

Recent news surrounding the company includes the release of highly anticipated video game titles and collaborations with popular franchises. Analyst sentiment has been positive, citing strong sales performance and growth potential in digital gaming and esports markets.

On March 5th, the company announced that it will build a concert hall with a capacity of 2,000 people in Shibuya District, Tokyo. The Shibuya District is a famed as the entertainment district of Tokyo with tons of arcade gaming centers and Anime Stores lining the street.

With the hall expected to open its gates in Spring 2026, this initiative has the potential to significantly support the company’s dwindling cash flow performance and serve as a Cash Cow segment over the years to come.

On the flipside, potential risks include competition from other entertainment companies, market saturation in certain segments, and exposure to foreign exchange fluctuations. Additionally, reliance on hit-driven content creation poses a risk to consistent revenue generation.

Investors Perspective

From an investor’s perspective, Bandai Namco Holdings Inc presents an attractive investment opportunity for investors seeking exposure to the entertainment sector. With a strong portfolio of popular franchises, consistent revenue growth, along with growth prospects in digital gaming and esports, the stock offers potential upside for long-term investors.

Your profit as an investor comes from dividends and capital gains. It is important to understand that the dividend yield for Bandai is a modest 2.1%. A lower dividend yield is common in corporations prioritizing growth.

Hence, if you choose to invest in this stock most of your returns would be derived from capital gains and is not a good investment if your goal is to receive a steady cash flow from your investment.

Conclusion

To conclude, Bandai Namco Holdings Inc (NCBDF) appears to be an attractive investment opportunity for long-term investors interested in the entertainment industry. With its diversified portfolio of popular franchises, consistent revenue growth, and established market presence, the company demonstrates resilience and potential for future expansion.

Despite facing industry-specific risks, such as competition and market saturation, Bandai Namco’s solid financial performance and strategic initiatives position it favorably for sustained growth. Therefore, considering the company’s intrinsic value and long-term prospects, we recommend NCBDF as a buy for investors with a horizon beyond the short term.

As Benjamin Graham famously said, “The stock market is filled with individuals who know the price of everything, but the value of nothing.” This sentiment underscores the importance of focusing on a company’s underlying value and growth potential rather than short-term market fluctuations. By adopting a long-term perspective, investors can potentially capitalize on the opportunities presented by companies like Bandai Namco Holdings Inc.

Article By: Hamza Bashir. An avid investor and strategic consultant with expertise in stock analysis. He has been investing, analyzing, and writing articles on the stock, cryptocurrency, real-estate, and commodities market for over 3 years.